XRP Price Prediction: Can XRP Reach $4.47 Amid Bullish Signals?

#XRP

- Technical Strength: XRP's price above the 20-day MA and Bollinger Bands' consolidation signal potential upside.

- Market Sentiment: Mixed but leaning bullish due to institutional adoption and regulatory clarity.

- Price Target: $4.47 achievable if resistance at $3.3689 is breached.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Market Consolidation

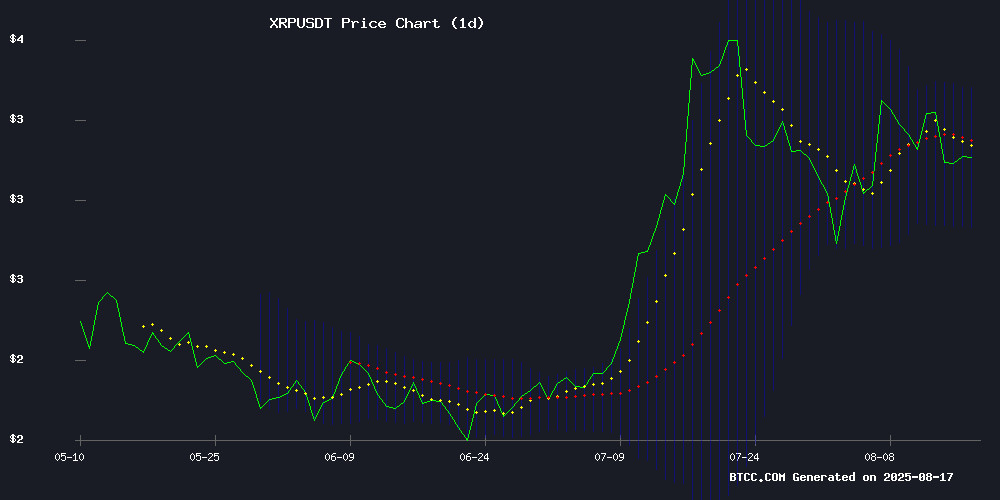

According to BTCC financial analyst James, XRP is currently trading at $3.1271, slightly above its 20-day moving average (MA) of $3.1015, indicating a potential bullish momentum. The MACD (12,26,9) shows a bearish crossover at -0.0497, but the Bollinger Bands suggest a consolidation phase with the price hovering NEAR the middle band ($3.1015). The upper band at $3.3689 could act as resistance, while the lower band at $2.8342 serves as support. James notes that a break above the upper Bollinger Band could signal a rally towards $4.47.

XRP Market Sentiment: Mixed Reactions Amid Regulatory and Institutional Developments

BTCC financial analyst James highlights the mixed market sentiment surrounding XRP. Positive developments include the launch of XRP cloud mining contracts and adoption by U.S. pharmacies, which could drive demand. However, large holder sales and ongoing SEC lawsuit updates add pressure. James believes the bullish trend remains intact, especially with SEC reviewing XRP ETF applications and the Ripple lawsuit nearing conclusion. The prediction of XRP reaching $1,000 by advocates is seen as overly optimistic, but a rally to $4.47 is plausible if market conditions improve.

Factors Influencing XRP’s Price

ETHRANSACTION Launches XRP Cloud Mining Contracts Offering Passive Income

ETHRANSACTION has introduced XRP cloud mining contracts, promising daily passive income of up to $22,800. The platform targets investors seeking to capitalize on XRP's fast transaction speeds and low fees without the volatility of active trading or the hassle of traditional mining setups.

The service eliminates the need for expensive hardware or technical expertise, offering tiered contract plans ranging from $19 to $1,300 investments. Returns are structured as fixed-profit schemes, with the entry-level plan yielding a 4.7% return in undisclosed timeframe.

XRP continues gaining traction in cross-border payments, with this cloud mining product positioning itself as an automated yield solution. The platform requires no coin ownership upfront—users purchase hashpower contracts denominated in fiat amounts.

XRP Faces Intense Pressure from Large Holder Sales

XRP's price stability around the $3 mark is being tested as significant whale activity disrupts the market. Addresses holding 10 million to 100 million XRP have offloaded roughly 400 million tokens—worth over $1.2 billion—in the past week. This sell pressure has introduced pronounced volatility, though exchange outflows suggest smaller investors are countering the downward momentum.

Nearly 77 million XRP ($231 million) exited exchanges in 24 hours, signaling accumulation behavior. "Large-scale sales create short-term uncertainty," analysts note, but the shrinking exchange supply reveals underlying demand. The tug-of-war between whale disposals and retail hoarding will dictate whether critical support levels hold.

Wellgistics Health Launches XRP Payments for U.S. Pharmacies

Wellgistics Health Inc. (NASDAQ: WGRX) has rolled out a payment system leveraging the XRP Ledger for independent pharmacies nationwide. The initiative enables instant drug inventory payments with transparent costs and secure transactions, marking one of healthcare's first large-scale blockchain deployments.

Linked to RxERP, a pharmaceutical e-commerce platform, the system offers pharmacies instant settlement, reduced fees compared to credit cards, and real-time payment tracking. Brian Norton, CEO of Wellgistics, noted strong interest from forward-thinking pharmacy owners recognizing blockchain's transformative potential. The platform currently serves 6,500 pharmacies and 200 manufacturers.

Is It Worth Buying XRP in 2025?

XRP surged to $3.12 in 2025 after Ripple and the SEC dropped their appeals, resolving a prolonged legal battle. The settlement clarified that XRP sales on public exchanges are not securities, though institutional trades remain restricted. Trading volume spiked 200% within a day, reflecting renewed market confidence.

The token rebounded nearly 99% from its April low of $1.79, now trading between $3 support and $3.60 resistance. Analysts project year-end targets of $3.50-$5.00, though technical indicators warn of potential pullbacks from profit-taking.

XRP's Bullish Trend Signals Potential Rally to $4.47 Amid Market Consolidation

XRP has demonstrated a consistent pattern of higher highs and higher lows since June, suggesting a potential upward trajectory toward $4.47. Despite a 6% retracement in yesterday's broader market downturn, the asset remains firmly above the $3 support level, reinforcing bullish sentiment.

Analyst VirtualBacon highlights XRP's structured uptrend since April's low of $1.61, with successive peaks at $2.64 in May and $3.66 in July. The August 3 dip to $2.74 established another higher low, positioning XRP for further gains—provided it maintains support above this level.

Notably, XRP has breached its 2018 all-time high, leaving no significant resistance ahead. The absence of overhead barriers, coupled with sustained consolidation, fuels speculation of new record prices. Debate persists over XRP's true all-time high, but technical structure now dictates the narrative.

SEC Updates Court on Ripple Lawsuit Developments

The SEC has formally updated the Second Circuit Court of Appeals on the status of its protracted legal battle with Ripple Labs. The regulator disclosed a joint motion to dismiss both its appeal and Ripple's cross-appeal, with each party bearing its own legal costs—a procedural step signaling potential settlement discussions.

Earlier this April, the SEC sought a 60-day pause in proceedings to explore resolving the case. Proposed terms included reducing Ripple's penalty from $125 million to $50 million and lifting injunctions against institutional XRP sales. While Judge Analisa Torres initially rejected these modifications, both parties persist in pursuing revised terms.

XRP Advocate Predicts Market Sentiment Shifts as Token Climbs to $1,000

XRP advocate Armando Pantoja has mapped out potential market reactions as the cryptocurrency ascends from single digits to four-digit valuations. At its current price of $3.06, XRP would need just a 31% surge to breach the $4 threshold—a level Pantoja believes skeptics would still dismiss as insignificant.

Between $10 and $15, sidelined investors may grow uneasy, clinging to hopes of re-entering below $1. This aligns with analyst BarriC's view that critics would transition from ignoring XRP to questioning its resurgence after years of trailing Bitcoin.

The true inflection point arrives at $100, where Pantoja anticipates widespread panic among former detractors. The projection mirrors Black Swan Capitalist Versan Aljarrah's thesis that triple-digit XRP valuations would reflect its foundational role in tokenized finance.

CryptoMiningFirm Introduces XRP Mining Contracts, Promising Daily Earnings Up to $19,967

CryptoMiningFirm has launched XRP mining contracts, transforming the non-minable asset into a passive income generator. The platform leverages cloud technology and sustainable energy to simulate mining, offering daily returns without hardware requirements.

XRP's utility in cross-border payments now extends to revenue generation through optimized cloud operations. Investors gain instant daily payouts, global accessibility, and enterprise-grade security via McAfee® and Cloudflare® protections.

The initiative marks a strategic pivot for XRP holders previously limited to trading profits. Early adopters benefit from multi-tier incentives, though the $19,967 daily claim requires independent verification.

Analyst Highlights XRP's Resilient Bull Run Amid $3 Price Support

XRP is navigating what one prominent analyst describes as its "hardest" bull run yet, with potential for significant investor gains. The cryptocurrency has demonstrated remarkable resilience above the $3 threshold, a level it first reclaimed in January 2025 after seven years. After initial struggles to maintain this position, XRP solidified $3 as support by mid-July—a development widely interpreted as a bullish signal.

Technical analyst Steph points to a decisive breakout above a multi-year descending trendline on XRP's weekly chart. Historical patterns suggest such breakouts often precede explosive price movements. Similar scenarios played out in September 2022 when XRP surged to $0.55 following a comparable technical pattern.

SEC Reviews Multiple XRP ETF Applications Amid Regulatory Clarity

The U.S. Securities and Exchange Commission is actively reviewing several XRP ETF applications, with most pending final decisions. Regulatory clarity has improved following the dismissal of the Ripple lawsuit, renewing optimism for approvals.

ProShares Ultra XRP ETF, filed on January 17, 2025, has already secured approval for listing on NYSE Arca and launched on July 18, 2025, offering 2x leveraged exposure to XRP futures.

Grayscale's application to convert its XRP Trust to an ETF, filed on November 21, 2024, awaits an SEC decision by October 18, 2025. Similarly, 21Shares and Bitwise have filings under review, with decisions expected on October 19 and 20, 2025, respectively.

Canary Capital's October 2024 filing aims to provide direct XRP exposure without requiring investors to hold the asset directly. The market watches closely as these developments could significantly influence XRP's institutional adoption.

Ripple vs SEC Lawsuit Nears Conclusion With Joint Dismissal

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission has reached its practical conclusion. Both parties filed a joint motion to dismiss appeals this week, leaving only administrative closure by court clerks. Former SEC attorney Marc Fagel emphasized no judicial approval remains required, stating "it's essentially over already" in a social media post that circulated widely across cryptocurrency communities.

Market participants reacted swiftly to the development, with XRP showing notable price movement following Ripple's official confirmation of the lawsuit's termination. The resolution marks the end of a landmark case that began in December 2020 and served as a bellwether for regulatory clarity in digital asset markets.

How High Will XRP Price Go?

Based on technical and fundamental analysis, BTCC financial analyst James projects a near-term target of $4.47 for XRP, contingent on breaking key resistance levels. Below is a summary of critical data points:

| Metric | Value |

|---|---|

| Current Price | $3.1271 |

| 20-Day MA | $3.1015 |

| Bollinger Bands (Upper/Middle/Lower) | $3.3689 / $3.1015 / $2.8342 |

| MACD (12,26,9) | -0.0497 | 0.0300 | -0.0797 |